tax shield formula excel

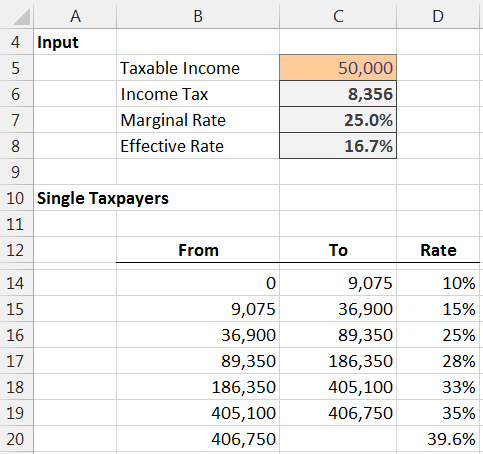

Add a Tax column right to the new tax table. Effective Tax Rate is calculated using the formula given below.

Why Do You Add Back Depreciation And Not Depreciation After Tax To Net Income When Calculating Fcff Doesn T Depreciation Create A Tax Shield Quora

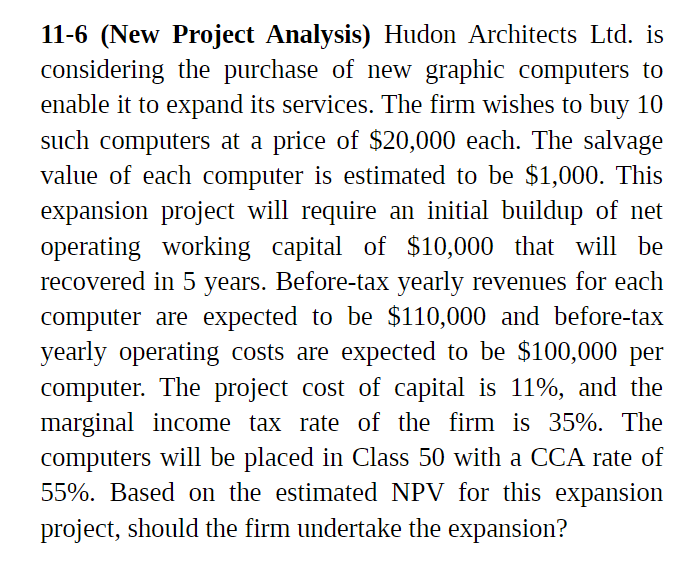

PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for.

. Depreciation Tax Shield Formula Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage. A tax shield is a reduction in taxable income for an individual or corporation achieved through. Tax shield Debt.

Sometimes you may get the price exclusive of tax. Click into the cell you will. The effect of a tax shield can be determined using a formula.

Capital structure earnings leverage debt equity assets management tax shield taxation financial management finance corporate finance For more details. To learn more launch. In the line for the initial cost and salvage value NCS the salvage value should have a negative sign negative spending.

Tax Shield Value of Tax-Deductible Expense x Tax Rate. As such the shield is 8000000 x 10 x 35 280000. In this condition you can easily calculate the sales tax by multiplying the price and tax rate.

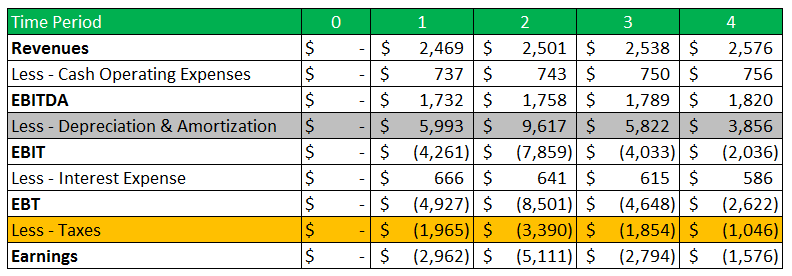

This is usually the deduction multiplied by the tax rate. The APV approach allows us to see whether. Select the cell you will place the calculated.

Additional negative sign in the formula CFFA OCF. The interest tax shield can be calculated by multiplying the interest amount by the tax rate. Interest Tax Shield Interest Expense Deduction x.

Interest Tax Shield Interest Expense x Tax Rate. In simple words we can say a tax shield is the PV Present Value of future tax saving attributes to tax deductibility of a particular expense in P and L Account ie profit loss account. In the Cell F6 type the formula E6D6 and then drag the AutoFill Handle until negative results appear.

TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest Expenses x tax rate. Effective Tax Rate Total Tax Expenses Taxable Income. We note that when depreciation expense is considered EBT is.

What is the formula to calculate tax. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. It is calculated by multiplying the tax rate with the depreciation expense.

To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. Tax Shield Deduction x Tax Rate. So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240.

Or EBT x tax rate. Tax shield formula excel. Since depreciation expense is tax-deductible companies generally prefer to maximize depreciation.

Adjusted Present Value Apv Formula And Calculator

Using Excel For Tax Calcs Jun 2019 Youtube

How To Calculate Income Tax In Excel

How To Npv Tax Shield Salvage Value Youtube

Depreciation Tax Shield Formula And Calculator

Depreciation Tax Shield Formula Examples How To Calculate

Cca Tax Shield Formula Pdf Public Finance Taxation

Using Apv A Better Tool For Valuing Operations

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Tax Shield Formula How To Calculate Tax Shield With Example

Wacc Formula Excel Overview Calculation And Example

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Calculating Pre Tax Cost Of Equity In Excel Fm

Tax Shield Formula Examples Interest Depreciation Tax Deductible

How To Calculate Tax In Msexcel Youtube

How To Npv Tax Shield Salvage Value Youtube